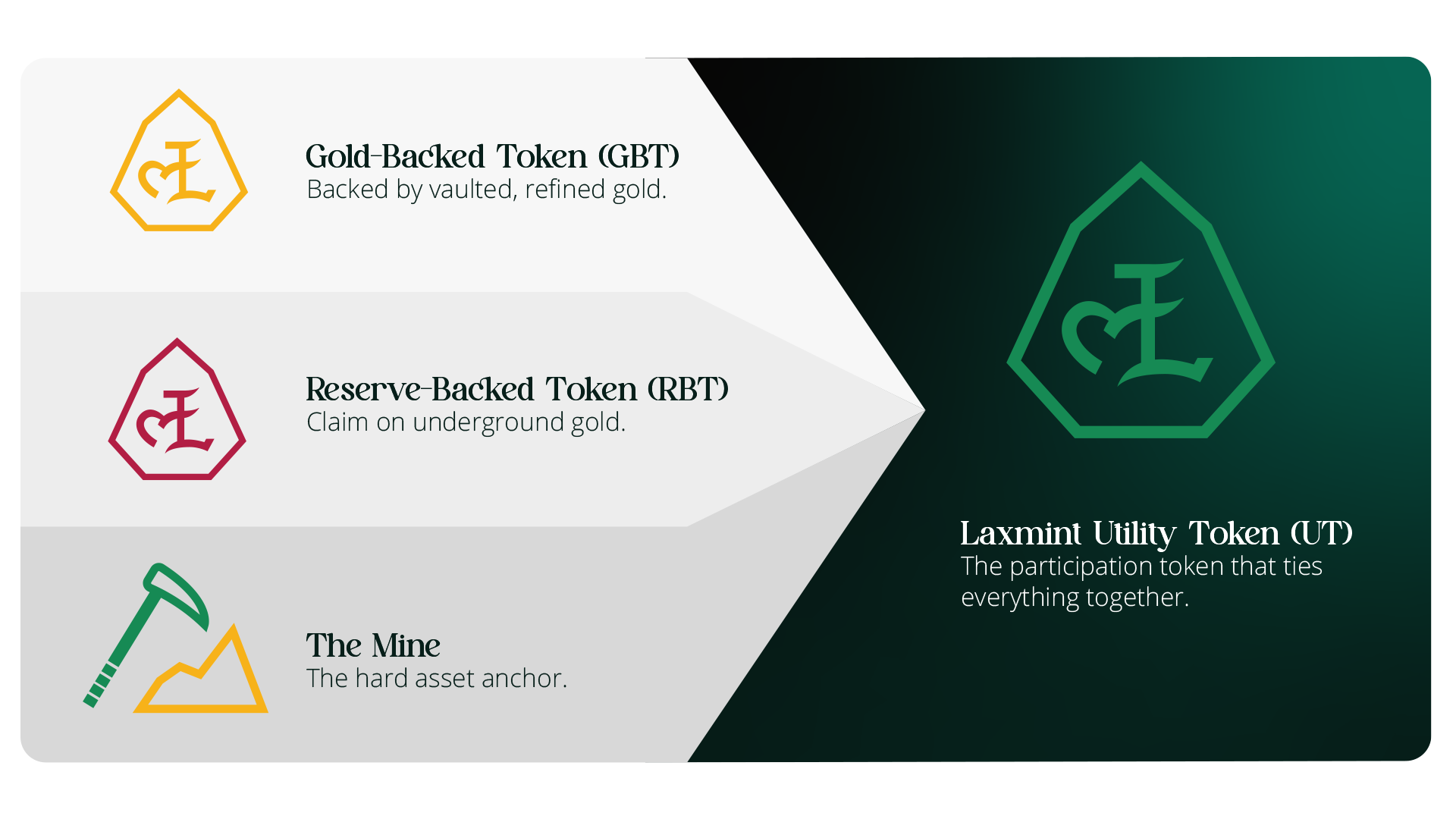

The platform is built on a three-token architecture designed for utility, verification, and value integrity.

The LAXMINT token forms the operational backbone of the ecosystem. It is not a representation of gold and not a financial security, but a pure utility token that powers access, participation, and services across the platform.

Core functions

- Access to dashboards, tools, and role-based permissions

Logging and verification of production data from mining sites - Minting and recording geological surveys and output batches

- Payment for network transactions and smart-contract execution

- Participation in governance and ecosystem development

- Leasing of equipment and access to operational support services

The token sustains an internal digital economy that encourages responsible participation, supports transparency, and maintains operational continuity.

When new gold reserves are professionally identified and certified, LAXMINT may issue Reserve-Backed Tokens representing the verified in-ground resource.

Each RBT is derived from geological surveys performed under internationally accepted standards (NI 43-101, JORC) and provides structured visibility of future potential value.

This framework enables institutional stakeholders, governments, and strategic partners to engage with gold at its source, supported by validated data and aligned with responsible production planning.

Following extraction, refinement, and secure storage, physical gold may be represented digitally through Gold-Backed Tokens that are fully backed 1:1 by audited gold held in certified vaults.

These tokens:

- Reflect verified ownership of real, vaulted gold

- Are issued via regulated custodians and independently audited channels

- Can be held, transferred, or redeemed under applicable laws and platform terms

- Offer a transparent, programmable interface with physical gold for institutional and sovereign participants

The GBT layer establishes a compliant, traceable bridge between physical gold and digital markets.

Token Flow

Designed for Responsible Growth and Institutional Readiness

Regulatory alignment underpins the entire LAXMINT ecosystem. All digital assets are structured for issuance and management within compliant frameworks, incorporating secure custody, independent audits, and legal governance adapted to regional requirements.

By aligning with evolving global standards, LAXMINT is developing infrastructure that meets the expectations of traditional finance, institutions, and sovereign stakeholders, establishing a trusted connection between real-world gold assets and the digital economy.

For Communities

Empowering local participation and reducing the marginalisation of miners and their environments.

- Revenue-sharing and local partnership models

- Access to leasing, infrastructure, and clean energy solutions

- Micro-financing for equipment and operational upgrades

- Onboarding tools for ESG compliance, training, and certification

- Support for health, water, and education initiatives

- Incentivised transition away from harmful practices (e.g. mercury use)

For Governments

Supporting national resource strategies through structure, accountability, and improved oversight.

- Real-time dashboards for reserve and production tracking

- Transparent licensing, royalties, and export verification

- Smuggling prevention through traceable supply chain data

- Environmental monitoring, impact reporting, and carbon credit eligibility

- A framework for monetising reserves without physical extraction or sale

For Industry & Institutions

Creating a secure, structured path to responsible gold engagement.

- Digital assets representing verified reserves and vaulted gold

- Tools for regulatory alignment and institutional compliance

- End-to-end traceability for ESG reporting and ethical sourcing

- Role-based access to geological data, batch-level records, and custody documentation

- Support for mitigating ecological and social risks commonly associated with gold production, including deforestation, water contamination, and labour exploitation